Other Insights

Dec 4 2025

AI at Work: How Microsoft 365 Copilot Is Moving Sales, Service, and Finance Teams to the Frontier

Sep 25 2022

What does Packaged foods, Medical/Pharma, Health Providers, Real Estate and Beverages have in common?

Need help or want to know more?

Find our contact info here

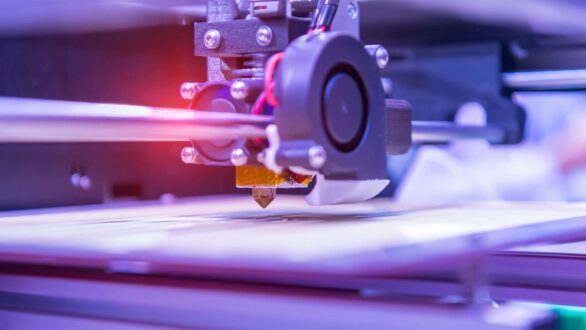

“DynamicsPrint® with IMP is the heart of our planning estimations and imposition systems.

Estimating has become an important science. Our young estimators can deliver accurate plans just as an experienced estimator, with loads of experience, would.”

Angel Viveros, Estimation Manager

Foli De Mexico, Mexico

“The reason we chose DP was because it’s an industry solution which solves many of the problems we had in the standard Microsoft Dynamics setup. Also, there was demand from the management to have final costing, which was also a major challenge in the standard Dynamics solution.

DynamicsPrint® also helps us greatly with scheduling and shop floor management. The data gathered gives us great insights, and results in a much more cost-efficient production.”

Jochem Sants, Project Manager

Van der Most, Heerde, Netherlands

“The professional and highly skilled DynamicsPrint® team led the implementation to develop the expertise internally at DCM with a team of Subject Matter Experts from each of the specialized print production areas. DynamicsPrint’s expertise regarding the system and the industry was instrumental to ensuring the configurations were done properly. As this is a highly configurable solution, the approach and implementation was very well structured and ensured that the team worked from the basic setups to the more complex setups with a pace that was manageable and retainable.

DynamicsPrint® adjusted the resource requirements to accommodate both technical and functional areas of expertise as needed throughout the project, providing best practice directives to ensure that the proper approach was being followed.”

Karen Redfern, VP Operations Technology

DCM, Canada

“I just wanted to let you know how happy I am with DynamicsPrint® and the support you have given KP San Leandro since our launch. The seemingly endless set of tools available really help us run and improve our business.

The visibility into job statuses, P&L, and the ability to create and manage cues that give our team a personalized look into their own area of responsibility have become essential to our business model. I can’t even imagine going back to our old system. Thanks to the DynamicsPrint® team for all your help and support.”

Mark Floyd, Division Director

KP Corp. San Leandro, USA

The Summer 2025 In-Plant Printing KPI Report, published by PRINTING United Alliance, provides a data-driven view into the evolving landscape of in-plant print operations. Drawing from a broad cross-section of operations — ranging in size, budget, and client focus — the report outlines how in-plants are navigating growth, labor challenges, and automation initiatives.

Wide-Format Printing Expands Across In-Plants

71.9% of in-plants surveyed now offer wide-format printing, with mid-sized and large operations leading adoption. Output is also growing steadily, averaging 8–9% growth in these segments. In-plants serving external clients are especially strong performers, with a 79.5% adoption rate and higher-than-average volume growth.

This trend reflects the value of wide-format as a strategic offering to reduce outsourcing and capture new revenue streams.

Page Volumes Continue to Climb

Color printing remains in high demand. Over 60% of respondents expect growth in four-or-more color print volumes. One-to-three-color and black-and-white volumes are expected to remain stable, with modest growth projected in each.

Mid-sized and large in-plants are once again the most optimistic, projecting the highest page volume increases in the year ahead.

Automation is a Strategic Imperative

Automation continues to gain traction, with 65.4% of in-plants actively pursuing equipment or workflow automation. Larger operations and those serving external clients are leading the way—indicating that scale and competitive pressure are key motivators.

Key automation goals include:

Improving productivity (54.6%)

Reducing turnaround time (43.8%)

Addressing skilled labor shortages (20.8%)

The data also shows that in-plants serving external clients are 20 percentage points more likely to invest in automation compared to internal-only operations.

Facing Uncertainty with Strategy

While tariff policy and economic sentiment remain a concern, the report closes with a key insight: in-plants that adopt strategic automation and expand services are positioning themselves for long-term resilience.

The data is clear — operational adaptability, service expansion, and forward-looking investment are defining characteristics of top-performing in-plants heading into the second half of the decade.

Book Demo