Other Insights

Dec 4 2025

AI at Work: How Microsoft 365 Copilot Is Moving Sales, Service, and Finance Teams to the Frontier

Sep 25 2022

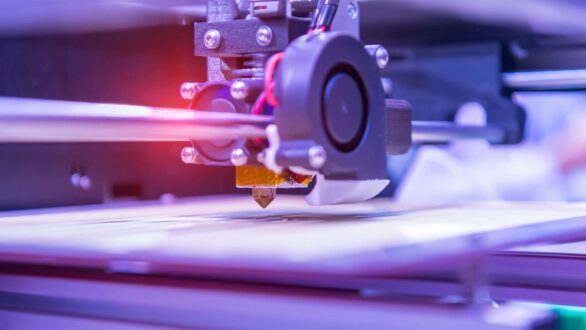

What does Packaged foods, Medical/Pharma, Health Providers, Real Estate and Beverages have in common?

Need help or want to know more?

Find our contact info here

“DynamicsPrint® with IMP is the heart of our planning estimations and imposition systems.

Estimating has become an important science. Our young estimators can deliver accurate plans just as an experienced estimator, with loads of experience, would.”

Angel Viveros, Estimation Manager

Foli De Mexico, Mexico

“The reason we chose DP was because it’s an industry solution which solves many of the problems we had in the standard Microsoft Dynamics setup. Also, there was demand from the management to have final costing, which was also a major challenge in the standard Dynamics solution.

DynamicsPrint® also helps us greatly with scheduling and shop floor management. The data gathered gives us great insights, and results in a much more cost-efficient production.”

Jochem Sants, Project Manager

Van der Most, Heerde, Netherlands

“The professional and highly skilled DynamicsPrint® team led the implementation to develop the expertise internally at DCM with a team of Subject Matter Experts from each of the specialized print production areas. DynamicsPrint’s expertise regarding the system and the industry was instrumental to ensuring the configurations were done properly. As this is a highly configurable solution, the approach and implementation was very well structured and ensured that the team worked from the basic setups to the more complex setups with a pace that was manageable and retainable.

DynamicsPrint® adjusted the resource requirements to accommodate both technical and functional areas of expertise as needed throughout the project, providing best practice directives to ensure that the proper approach was being followed.”

Karen Redfern, VP Operations Technology

DCM, Canada

“I just wanted to let you know how happy I am with DynamicsPrint® and the support you have given KP San Leandro since our launch. The seemingly endless set of tools available really help us run and improve our business.

The visibility into job statuses, P&L, and the ability to create and manage cues that give our team a personalized look into their own area of responsibility have become essential to our business model. I can’t even imagine going back to our old system. Thanks to the DynamicsPrint® team for all your help and support.”

Mark Floyd, Division Director

KP Corp. San Leandro, USA

The Q2 2025 Quarterly Services Report from the U.S. Census Bureau reveals a tale of two industries: publishing, struggling to regain momentum, and advertising, continuing its digital-led ascent. For those in media, print, and packaging, these trends are more than economic indicators — they reflect fundamental shifts in how content is consumed, monetized, and valued.

Publishing: Still Finding Its Footing

Publishing revenues have endured two decades of disruption. The pandemic caused sharp declines, followed by a short-lived rebound — particularly in books. But by mid-2025, the numbers show a flatlining across all segments:

Newspapers continue a steep and steady decline, losing over $50B in annual revenue since 2004.

Periodicals have followed a pattern of decline marked by periods of brief stability, but with no real recovery since advertisers began pivoting to digital in the mid-2010s.

Books, despite a post-pandemic bump, have remained largely stagnant through 2024 and into 2025.

The picture is clear: print publishing is stabilizing — not growing. And stability, in today’s media economy, can be a precarious position.

Advertising: A Digital-First Economy

Advertising tells a very different story. While the 2008 financial crisis caused a significant dip, the recovery was quick — and the long-term trend has been upward and digital.

Ad revenue growth has shifted from traditional channels like print and broadcast toward:

Streaming services (despite consumer pushback on ad-supported models)

Social platforms

Content marketing and influencer ecosystems

Hybrid models, where once ad-free platforms now introduce subtle monetization tactics

Interestingly, despite fatigue with ads — evident in consumer willingness to pay for ad-free subscriptions — advertising platforms remain ubiquitous. Even refrigerators, as Samsung recently demonstrated, may become vehicles for display ads.

A Shifting Revenue Model

For those in print, packaging, or publishing-adjacent industries, this shift is not merely a cautionary tale — it’s a signal to rethink how value is created:

In publishing: diversification and digital transformation are no longer optional.

In advertising: agility and platform fluency are essential to follow audience attention.

In media production: businesses must reconcile sustainability and scale with new monetization models.

Final Thought

The Q2 2025 data doesn’t just report on the past — it projects forward. As publishing stabilizes and advertising accelerates, the divide between traditional content production and modern content monetization will only widen.

The question for business leaders is no longer whether to adapt — but how fast.

Book Demo